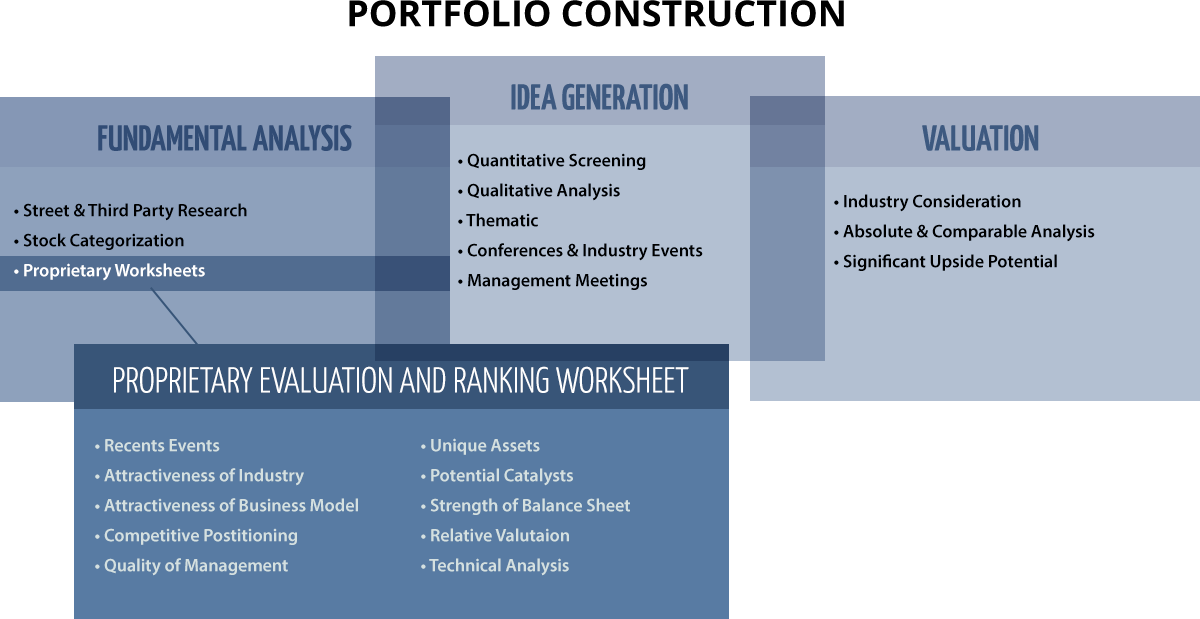

The portfolio managers follow a three-step process to identify and monitor the Funds’ investments:

The first step is to narrow the seemingly infinite universe of possibilities and to focus on what Jacob Asset Management (JAM) feels are the most attractive investment opportunities. This requires considerable research time – scouring the Web, reading analyst reports, running quantitative screens, attending conferences, speaking to executives – all in an attempt to find those relatively rare nuggets worth looking into more closely.

With each intriguing investment idea, JAM deploys a thorough qualitative and quantitative review process to determine the attractiveness of the opportunity. Ideally, JAM looks for companies that operate in large markets with significant barriers to entry, hold a strong competitive position with growing market share, and have capable management teams with proven track records. JAM values unique assets – such as proprietary technologies or unusually loyal customers – with the possibility that positive near-term catalysts could drive the value of the investment.

The team then turns their focus to valuation and evaluates many different quantitative criteria. JAM estimates what a company is likely to generate in sales and profits for the coming years and then, using several different metrics, calculates a fair valuation.

Once JAM adds an investment to one of the portfolios, the team continues to monitor the position closely, making sure that the original analysis remains valid. JAM will often rebalance or potentially exit a position if the risk/reward ratio for the investment changes materially.